Netflix Earnings – Q2 2025

Netflix is set to report quarterly earnings today after the U.S. market closes. This release corresponds to the company’s second fiscal quarter of 2025.

What is the market expecting?

The market is anticipating solid growth in both revenue and earnings, driven by the strong performance of the ad-supported tier and new content strategies.

Revenue is projected between $11.05B and $11.10B, reflecting a +16% YoY increase.

EPS is expected to be $7.07, a 45% increase compared to the same period last year.

Key themes to watch in the report:

- Performance of the ad-supported tier is critical to sustaining growth.

- Impact of recent price hikes on churn and profitability.

- Expansion in emerging markets and updates on global subscriber growth.

- Progress in live sports content strategy: NFL, WWE, and upcoming deals.

- Outlook for the rest of the year and ability to sustain the operating margin (currently at 33%).

Stock price expectations:

Wall Street sentiment remains positive.

- Average price target: $1,330 (Visible Alpha)

- Highest projection: $1,600 (Pivotal Research)

- Targets between $1,400–$1,500 from Guggenheim, Wells Fargo, and Bank of America

- JPMorgan remains cautious, with a $1,220 target, arguing that much of the growth is already priced in.

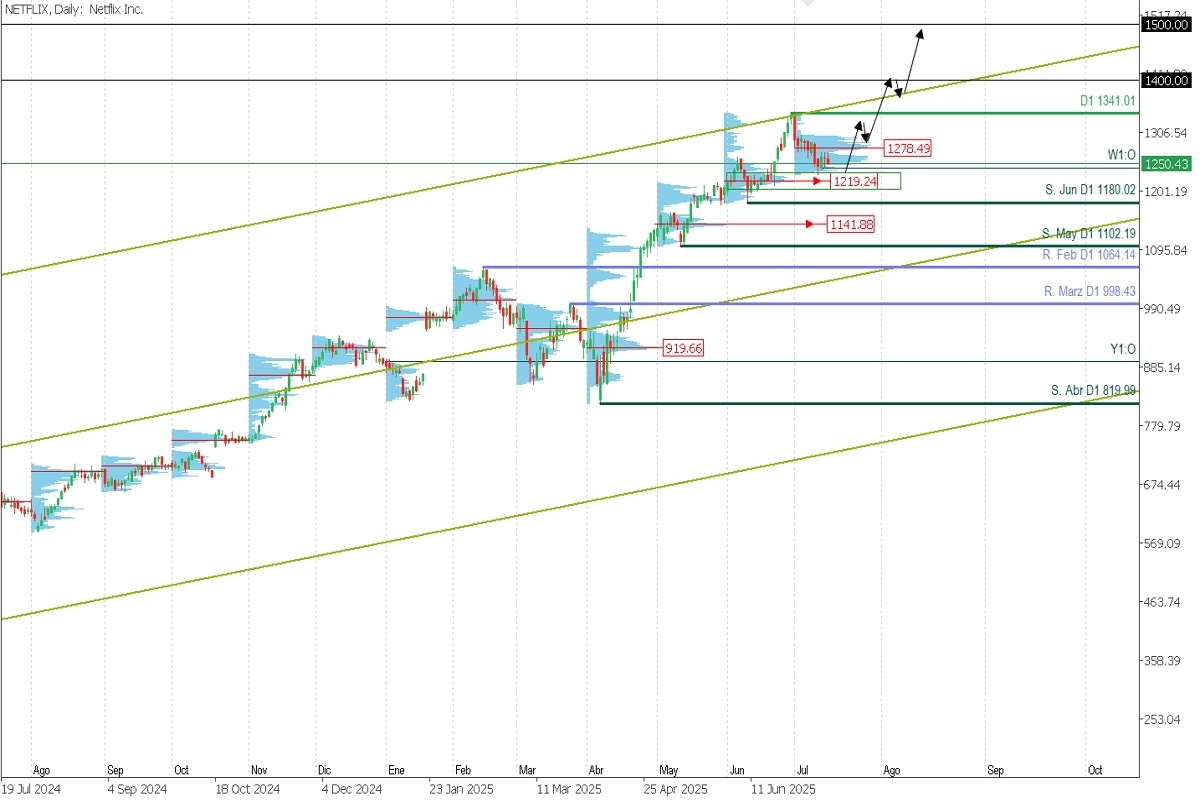

Technical Analysis | Daily

The rally from April has taken the stock to a new all-time high at $1,341.01, from where it began a correction earlier in July, seeking liquidity around the June demand zone near $1,219.24.

This move leaves the June low at $1,180.02 as the last key daily support, meaning the bullish continuation depends on that level holding.

A bullish continuation is expected given the strong growth outlook, with potential acceleration toward the upper boundary of the ascending linear regression channel, aiming for $1,400 and $1,500 over the coming weeks.