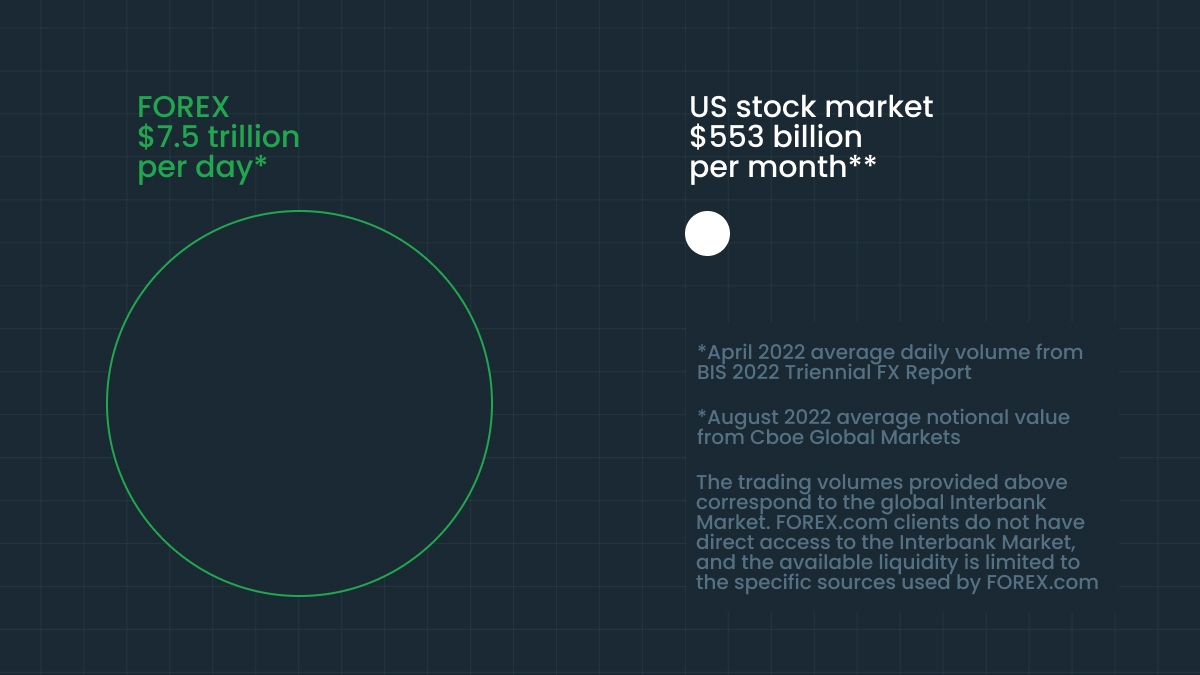

Forex trading continues to attract millions of traders around the world. Every day, around $7.5 trillion moves through the Forex market, and for good reason! As the largest financial market, it plays a central role in global commerce.

In this article, you’ll get a clear view of the key benefits of trading Forex, what makes this market unique, how it compares to others, and why so many traders choose it every day.

Risk reminder

Before we talk about the benefits, let’s stop for a moment and look at the risk. In Forex, leverage lets you control big trades with only a small amount of money. The problem is, it multiplies both profits and losses. A winning trade can grow your account fast, but a losing one can wipe it out just as quickly. Smart traders always set a stop-loss, keep their trade sizes small, and never risk money they can’t afford to lose.

Core benefits of trading Forex

Forex is where people and companies exchange money from different countries. For example, when someone sends money abroad, when a business pays for products from another country or when people invest internationally, it all happens through the Forex (foreign exchange) market.

This market has become a favorite for traders of all sizes. People like it because:

Getting started is easy. You can begin with any amount of money.

Most brokers don’t charge extra fees, so it’s a low-cost market. They earn from the small difference between the buy and sell price (spread). It depends on the broker and account type, but FBS doesn’t charge any commissions.

It works no matter your budget. Whether you have $100 or $1 million, the strategy can stay the same.

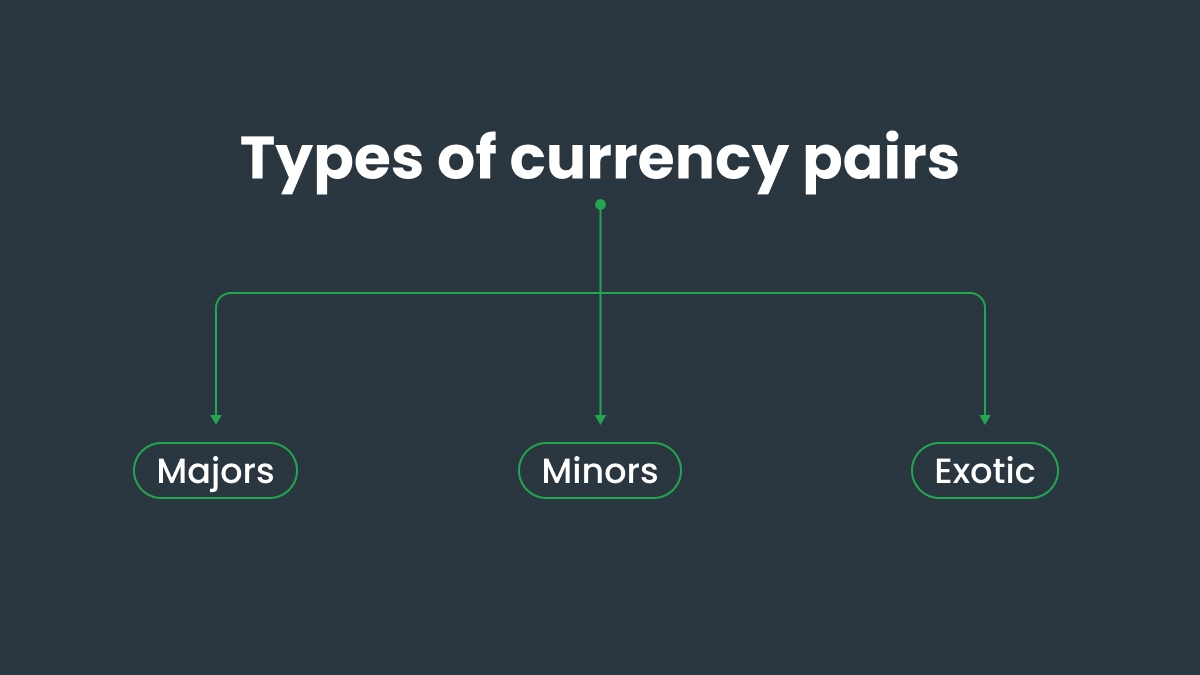

Trading is simple to follow. You always trade in currency pairs, like buying euros and selling dollars. You can earn money when prices go up or down.

Key terms every beginner should know

Pip: In most currency pairs, a pip is the smallest price change. It usually shows up in the fourth decimal place — for example, if EURUSD moves from 1.1000 to 1.1001, that’s one pip.

Lot: A standard lot equals 100 000 units of the base currency. If you're starting with a small account, mini lots (0.1) and micro lots (0.01) are useful because they allow you to place smaller trades.

Spread: The difference between bid and ask price. It’s built into the price and depends on the pair, broker, and market conditions.

Margin: When you use leverage, your broker holds a portion of your funds as margin. It’s like a deposit that backs up the size of your trade.

Base / Quote: Every Forex pair has two parts. The base currency comes first (like EUR in EURUSD), and the quote currency comes second (USD). The price tells you how much of the quote you need to get one unit of the base.